Re-Claim Your Time: How AI is Making Claims Adjusting Faster and More Fulfilling

Brandon H. Littles, Five Sigma’s Global Solutions Expert and former claims leader, shares his personal experience on how AI in claims management is transforming claims adjusting. Read his blog to Learn how AI and automation helps adjusters reclaim their time, eliminate inefficiencies, and focus on decision-making, customer interactions, and meaningful work.

Vitesse and Five Sigma Partner to Expedite Payments and Enhance Customer Experience in Insurance Claims

Vitesse and Five Sigma have joined forces to accelerate insurance claims payouts by integrating AI-native claims management with real-time payments. This strategic partnership enables insurers, MGAs, and TPAs to automate claims settlements, reduce cycle times, and enhance policyholder experience through faster and more flexible disbursements. By streamlining claims handling from FNOL to final payment, insurers can eliminate delays, improve compliance, and gain better financial oversight. This collaboration marks a significant step toward a fully digital, automated claims ecosystem.

What is Specialty Lines Insurance? Types, Claims, and Innovation

Specialty lines insurance covers complex risks that standard P&C policies don’t, including cyber liability, environmental damage, pet insurance, and embedded coverage. Managing claims in these specialized markets requires adaptable workflows, industry-specific expertise, and seamless third-party data integration. Learn how specialty insurers navigate regulatory challenges, emerging risks, and claims complexity while leveraging configurable, no-code AI products to streamline claims handling and improve accuracy.

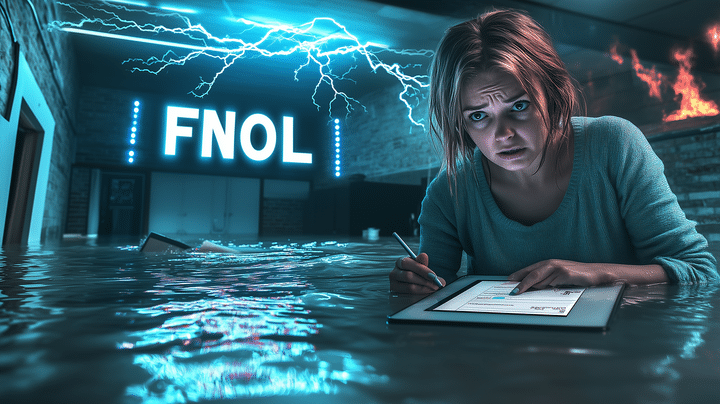

The Meaning of FNOL in Claims Management

What is the meaning of FNOL? the First Notice of Loss (FNOL) is the critical first step in the claims management process, marking the official report of an incident. FNOL automation is transforming the process, with AI tools reducing cycle times, improving data accuracy, and enhancing policyholder experience. Learn the meaning of FNOL, its step-by-step process, common challenges adjusters face, and how to overcome them.

Claims Management in the Age of Highly Intelligent Machines

In his thought-provoking article, Michael Krikheli, Co-Founder & CTO of Five Sigma, breaks down the AI revolution in claims management—where machines handle claims with superhuman precision. He explores AI’s ability to analyze policies, assess liability, detect fraud, and orchestrate the entire claims lifecycle, while also addressing the evolving role of adjusters and the risks of AI-led claims. Read on for a bold vision of the future—one where AI and human expertise create faster, smarter, and more customer-centric claims handling.

Go live in weeks with the state-of-the-art claims management platform.