Technology’s Role in Enhancing Self-Insurance Programs

Large companies choose self-insurance for better financial control and cost efficiency, yet struggle with disorganized claims management. Discover how technology can streamline processes, reduce costs, and improve efficiency in our latest blog.

From Tech-Assisted to Tech-Driven: The Future of Insurance Claims Management

Discover how AI and automation are transforming the insurance industry, shifting from technology assisting humans to humans supporting advanced tech. Learn about the Metamorphosis of insurance claims management, and the benefits of an AI-native platform like Five Sigma.

Let the Youngsters Lead: Embracing Digital Transformation in the Conservative Insurance Industry

Millennials and Gen Z insurance workers can reshape the insurance industry by leading digital transformation projects. However, in the conservative insurance industry, they’re not always given permission to change and adopt new technologies, like AI and automation. This is true also for claims teams, where modern claims management systems can boost efficiency and adjusters’ employee satisfaction.

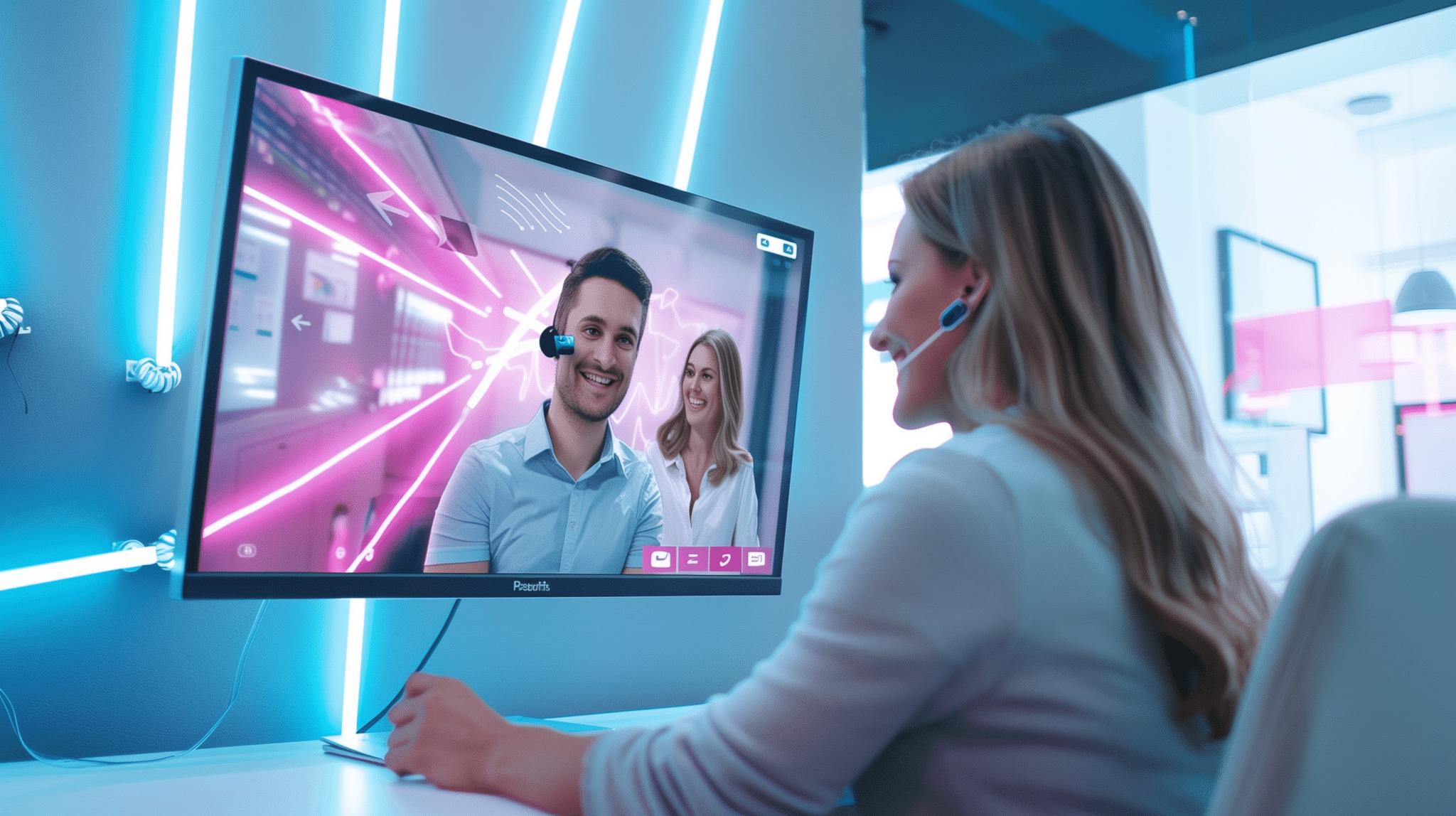

Product Updates & Innovations, May 2024: Video Calls Within Five Sigma

Five Sigma supports on-platform video calls, allowing adjusters to connect face-to-face with anyone related to the claim. Enhance your claims experience with real-time communication, seamless interactions, and faster resolutions.

Tego Partners with Five Sigma to Modernize Claims Management in Australia

Tego Insurance, a specialist medical malpractice underwriter in Australia, has chosen Five Sigma’s AI-Native, Automation-First platform to address the growing complexity and volume of claims. Five Sigma’s advanced claims management platform will enable Tego to automate routine tasks, integrate seamlessly with existing systems, and provide real-time insights.

Go live in weeks with the state-of-the-art claims management platform.