Introducing Our Embedded Performance QA Tool for Evaluating Claims Adjusters’ Performance

In the world of claims management, it’s no exaggeration to say that knowledge is power. And using information effectively is about more than just determining how much to pay out on a given claim.

In fact, at Five Sigma, our entire claims management solution (CMS) is built on the idea that an innovative approach to using claims data can help you optimize every aspect of your claims operation.

That’s why we’re so excited to introduce a new feature making our platform’s use of data even more robust for claims departments: This week we launched our Performance QA tool. For claims supervisors and other leaders, this new capability offers a streamlined, effective way to monitor and evaluate the performance of claims adjusters in order to help entire claims departments optimize their performance.

The Performance QA tool offers you a data-driven look at various aspects of claims adjusters’ job performance, including timeliness, payment accuracy, the adjudication process, and customer experience. By shedding light on adjusters’ KPIs, the new feature also helps you ensure regulatory compliance within your claims department.

How does the Performance QA tool work?

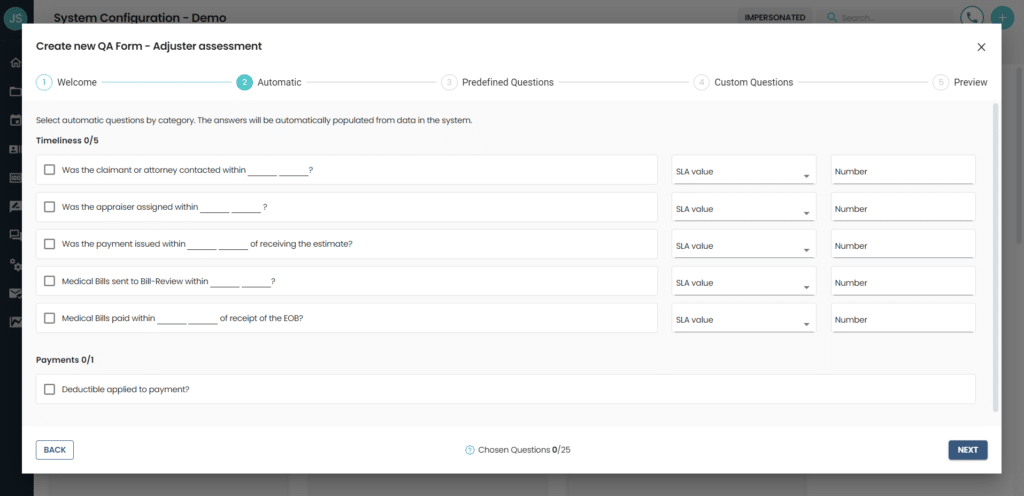

At the heart of the Performance QA tool is an approach to evaluating claims performance using flexible forms that can easily be designed by any claims leader. You can choose up to 25 questions to include on a form. Adding questions is a simple process that can be completed through our intuitive QA form wizard, with no need for help from IT or developers.

When creating a form, you can include three types of questions:

- Automatic questions, the answers to which are automatically populated from claims data in the system.

- Predefined questions, which can be chosen from our library of questions developed based on our experience working with multiple carriers.

- Customer questions, which can be built by a claims manager in a yes/no format. The manager can choose the relevant category (timeliness, adjudication, payments, or customer experience) for each customer question.

Once a form has been created and activated, you can use it to evaluate the performance of claims adjusters. The Performance QA tool makes it easy to find and choose a sample of claims to evaluate, letting you filter claims based on coverage type, incident type, incident subtype, adjuster, sub-organization, line of business, and date range.

Once you choose a specific claim to evaluate and then run a query for it, automatic questions will immediately be answered based on data already in the system, and you will be prompted to answer the predefined questions and customer questions. Then, the system will use this information to provide a score for the claim. After a number of queries have been run, you can view a summary of the results for a given time period, broken down by claims adjuster.

How does our newest feature supplement our platform’s other capabilities?

By adding to our cloud-native claims management solution’s data-driven capabilities, the Performance QA feature makes our platform even more comprehensive and user-friendly.

Much of the data that can be provided by our Performance QA feature is automatically gathered as claims adjusters perform key steps in processing and resolving claims through our platform. By providing easy access to KPIs that are already stored within our solution, the new tool offers claims leaders a streamlined way to make the most of their data for the purpose of quality assurance. And by making it remarkably quick and easy to answer additional questions about claims, the feature makes the QA process both flexible and efficient.

This way, our claims management solution helps supervisors and other claims leaders to gain valuable insight into the performance of each claims adjuster.

Because ultimately, QA is not just about evaluating job performance but also about optimizing that performance.

For more on our new Performance QA tool, check out our press release.