Qover, an enabler in embedded insurance, harnesses Five Sigma’s AI-native claims management platform to optimize operations and deliver exceptional customer experience across 32 countries.

Read this case study to discover how Qover streamlined claims handling, adapted to multi-national requirements, and rapidly scaled new Lines of Business with Five Sigma’s AI-native claims management technology.

Qover: A Leading Embedded Insurance Orchestrator

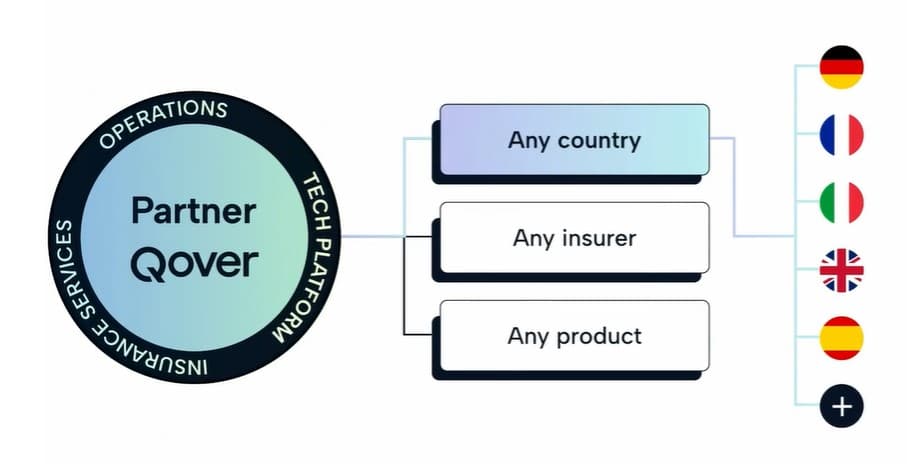

Qover is a pan-European embedded insurance company providing seamless digital insurance services to millions of users across Europe. Operating in various industries such as financial services, mobility, and e-Commerce, Qover helps its partners deliver an exceptional user experience across any product, country, or insurer.

The Challenge: Add New Lines of Business Quickly, Internalize Claims Management, and Accommodate Multi-National Requirements

Qover’s mission is to provide leading businesses and insurance providers with the ability to orchestrate insurance through technology, enriching their value proposition. The brands that Qover services have sophisticated digital platforms, operate across multiple countries, and require tailored customer experiences.

Qover works with a variety of brands, adding new lines of business (LoB) coverage to its portfolio almost on a daily basis. Due to the dynamic nature of its work, Qover needed an adaptable and agile claims management system (CMS) that allows for quick and easy LoB addition and configuration. This strategy aimed to accelerate Qover’s sales and claims handling processes and to deliver better quality of service to Qover’s customers.

As a pan-European company, Qover also faced complexities relating to accommodating different languages, currencies, and regulatory requirements in each market. This required a robust, flexible, and scalable claims management system that accommodates many variants.

Qover Chooses Five Sigma as its Claims Management Platform

After thorough market research and analysis, contacting over 15 CMS providers, Qover chose Five Sigma.

Five Sigma was a great match for Qover for many reasons, but mostly for the Five Sigma team’s flexible mindset, the advanced technology including API capabilities, and the cost-effective SaaS pricing model. These attributes provided Qover with the agility to scale its operations seamlessly without concerns about downtime or additional unexpected costs. This flexibility also allows Qover to focus on its insurance platform, drive product innovations, and strengthen its market leadership, expanding its ecosystem of partners and services.

Key Benefits of Five Sigma’s Claims Management Platform

One of the key features that impressed Qover was the ability of Five Sigma’s platform to support self-service, no-code configuration of new lines of business. This capability empowers Qover’s team to swiftly respond to market demands and integrate new insurance products without extensive IT intervention, at their own time and pace, and add new LoBs in days instead of weeks.

Qover also enjoys many additional benefits of Five Sigma’s AI-native platform:

- Advanced Automation: Streamlined processes and reduced manual tasks.

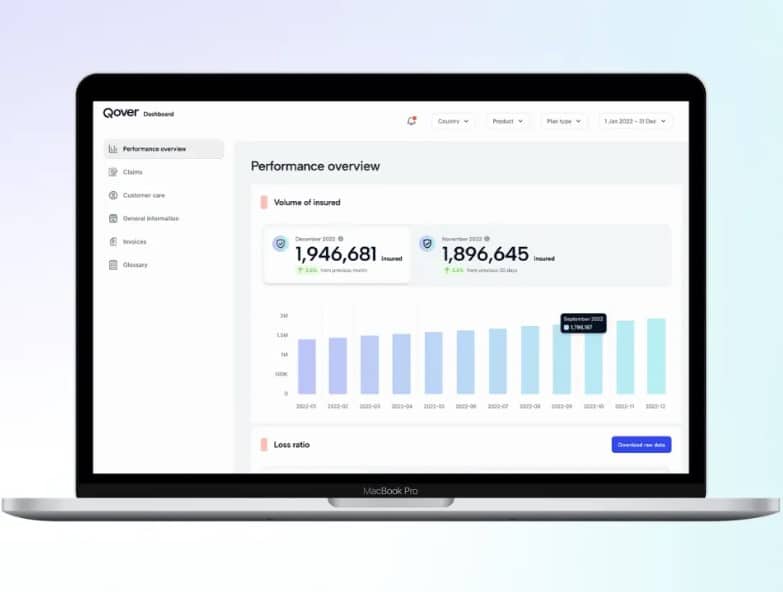

- Centralized Data: Real-time comprehensive visibility into all claims data in a single place.

- AI-Driven Insights: Data-based recommendations and next steps for claims handling, taking into account past and current data.

- Enhanced Customer Communication: Omnichannel communication hub for efficient interactions from within the platform, including communication logs and transcripts.

- Compliance: Automatic adherence to regulatory standards across the EU and its various countries.

The Implementation Process

The implementation process of Five Sigma’s claims management platform took only 16 weeks to go live with Qover’s first line of business, pan-European bike insurance, meeting a hard deadline with efficiency and precision.

The implementation involved co-designing new CMS features to handle multi-currency and multi-language aspects of the European market, ensuring the Five Sigma claims management platform meets Qover’s specific needs. As a SaaS platform, once such features are developed for Qover, they’re available going forward for the benefit of all customers.

Five Sigma’s platform addressed the multi-language challenges by creating automation rules that assign adjusters to claims based on language proficiency, ensuring that the assigned adjuster speaks the claimant’s native language.

Additionally, Five Sigma’s automation and no-code configurations expanded Qover’s capabilities to launch new lines of business almost instantly, ensuring that Qover’s claims team can always onboard new customers for embedded insurance.

Five Sigma’s team, which includes both experienced claims professionals and tech talent, provided Qover with valuable insights and ongoing support, ensuring seamless integration with Qover’s systems and clear communication.

By simplifying the claims process, reducing manual tasks, and focusing on quality and accuracy, Five Sigma enabled Qover to deliver an outstanding claims experience to its customers.

Five Sigma Delivering Results – Reducing Cycle Times and Accommodating New LoBs in Days

Leveraging Five Sigma’s Claims Management Platform yielded significant benefits for Qover:

Enhanced Efficiency

The ability to launch new P&C Lines of Business in 1-2 days (instead of approximately two months before) has drastically improved Qover’s operational agility, allowing the company to meet market demands swiftly.

Reduced Cycle Time

By streamlining and automating claims handling, Qover reduced claims cycle time from weeks to days, significantly improving customer satisfaction and loyalty.

Holistic View

Five Sigma’s platform provided Qover with an improved understanding of partner and customer needs, allowing for better feedback and product/process improvements. The holistic view of all claims data in one place enabled better decision-making and faster issue resolution.

With Five Sigma’s platform, Qover is able to achieve its goals of delivering a superior embedded insurance experience to customers across diverse markets.

Qover’s Favorite Features of the Five Sigma Claims Management Platform

When we asked the Qover team what they like most about Five Sigma, these were their answers:

Easy User Interface

Intuitive and easy to use interface, allowing adjusters to manage claims efficiently without extensive training.

Workflow Customization

The ability to configure claims workflows for different lines of business on their own, without making change requests to development and IT teams. This has been a game changer, giving adaptability to Qover.

Team Partnership

The positive collaboration with Five Sigma’s team has been instrumental. The commitment to continuous improvement and innovation aligns perfectly with Qover’s goals, making the partnership highly productive.

Integrated Communications

The platform’s omnichannel communication hub logs and transcribes all communications, automatically linking communications to specific claims. This feature is a game-changing improvement for transparency and operational efficiency.

What’s Next for Qover and Five Sigma?

Qover and Five Sigma share a deep commitment to transforming the insurance market through innovation. The introduction of Clive™, the insurance industry’s first AI Claims Adjuster by Five Sigma, will further streamline Qover’s claims operations, reduce claims leakage, and create opportunities for hyper-automation. Clive offers real-time assistance to claims adjusters and can execute various tasks in claims automatically, speeding up claims handling and enabling better customer service. Qover and Five Sigma and currently experimenting with new use cases for Clive in embedded insurance.