When it comes to an insurance company’s success, it’s hard to overstate the central role played by claims adjusters.

But just what does their work look like on a day-to-day basis? How many claims do they handle at a time, how long does it take them to resolve each claim, and how does that vary across various lines of business and various adjusters?

To shed light on the critical work claims adjusters do and how it impacts both insurers and customers, we at Five Sigma recently analyzed thousands of claims. Here’s a look at our key findings.

How many claims do adjusters handle at a time?

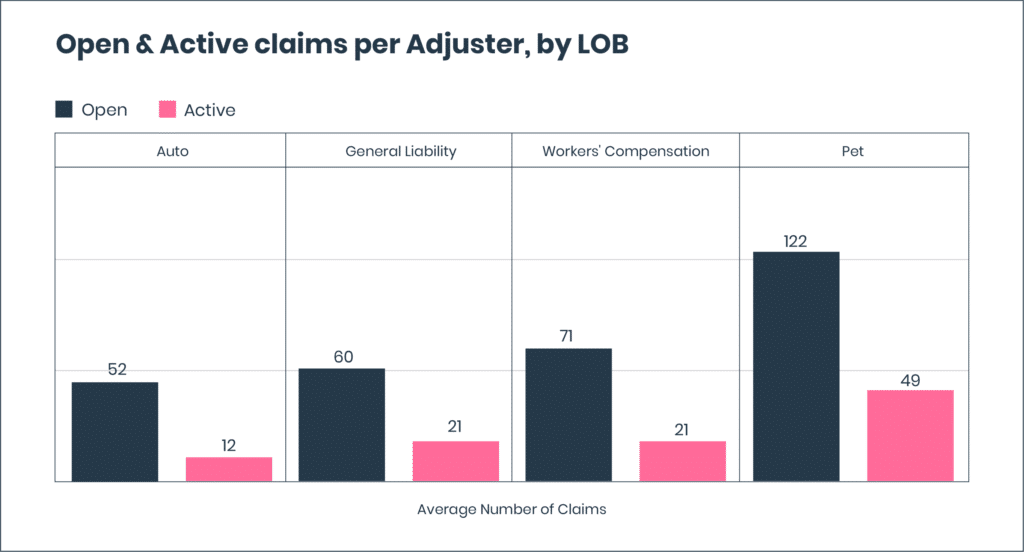

We started by examining the numbers of claims that adjusters across various lines of business have to handle at any given time. Specifically, we analyzed data for adjusters focusing on auto, general liability, workers’ compensation, and pet insurance.

For each line of business, we focused on two numbers:

- The average number of open claims per adjuster (including all claims assigned to a given adjuster that have not yet been closed).

- The average number of active claims per adjuster (including only the open claims on which the adjuster has actively worked in the past week).

Looking at our sample of claims, we can see that auto insurance claims adjusters have the fewest open and active claims, while pet insurance adjusters have the most. Meanwhile, the numbers for general liability and workers’ comp were far closer to those for auto insurance than to those for pet insurance.

Of course, this does not mean that auto insurance claims adjusters are less productive than pet insurance claims adjusters. While pet insurance claims tend to focus on relatively streamlined and straightforward issues of reimbursement for veterinary visits, auto insurance claims are often more intricate due to factors such as third-party claimants, the involvement of vendors, medical care, damage assessment, and questions of liability Given that complexity, it makes sense to expect auto insurance claims adjusters to have fewer open and active cases than their peers working in other lines of business such as pet insurance.

Zooming in on auto insurance claims adjusters

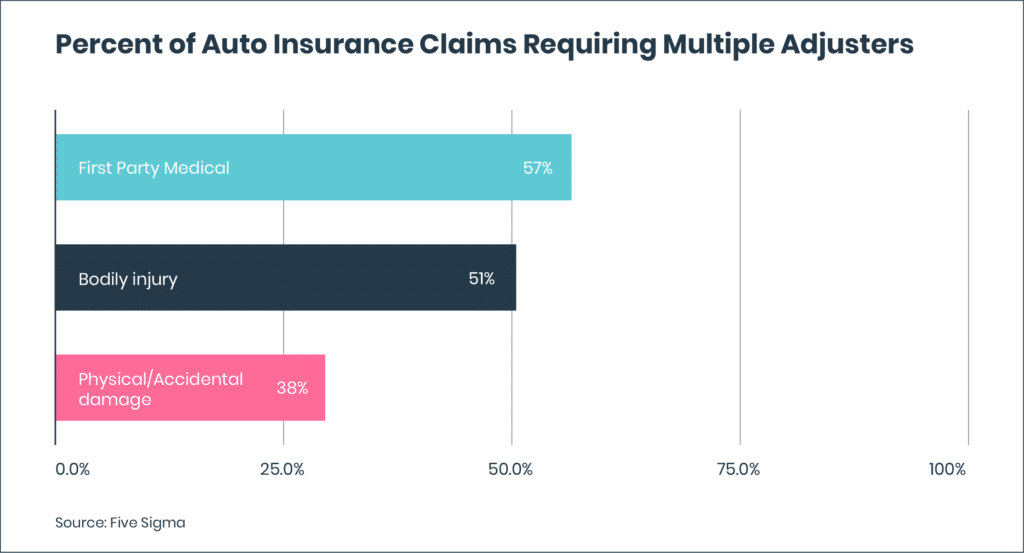

Some of our most interesting findings came from the world of auto insurance. Drilling down into our data, we were able to see how various types of auto insurance claims compare in their need for special expertise and how this impacts the speed with which these claims are handled.

Looking at our data on auto insurance claims from the past three months, we can see that first-party medical claims were the most likely (57%) to require multiple adjusters—meaning that they most frequently required specific expertise that the claim owner might not have. Bodily injury claims followed, also with a majority of claims (51%) requiring multiple adjusters. For claims related to physical/accidental damage, 38% of claims required multiple adjusters.

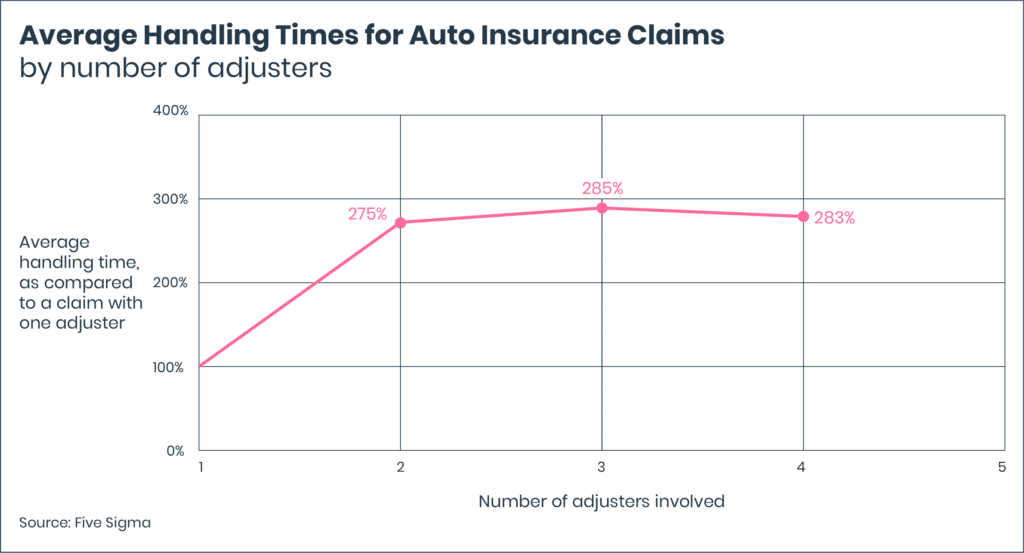

How does the need for multiple claims adjusters affect the time required to process a claim? Once a claim required more than one adjuster, handling time nearly tripled, typically requiring between 2.75 and 2.85 times the average. Interestingly, we found that it made little difference whether a claim required two, three, or four adjusters.

For claims departments, this finding underscores just how important it is to assign each claim to the right adjuster as quickly as possible. Assign a claim to an adjuster who will need help from a colleague, and you can immediately expect to see handling time nearly triple. And in the work of claims management, that kind of inefficiency is costly.

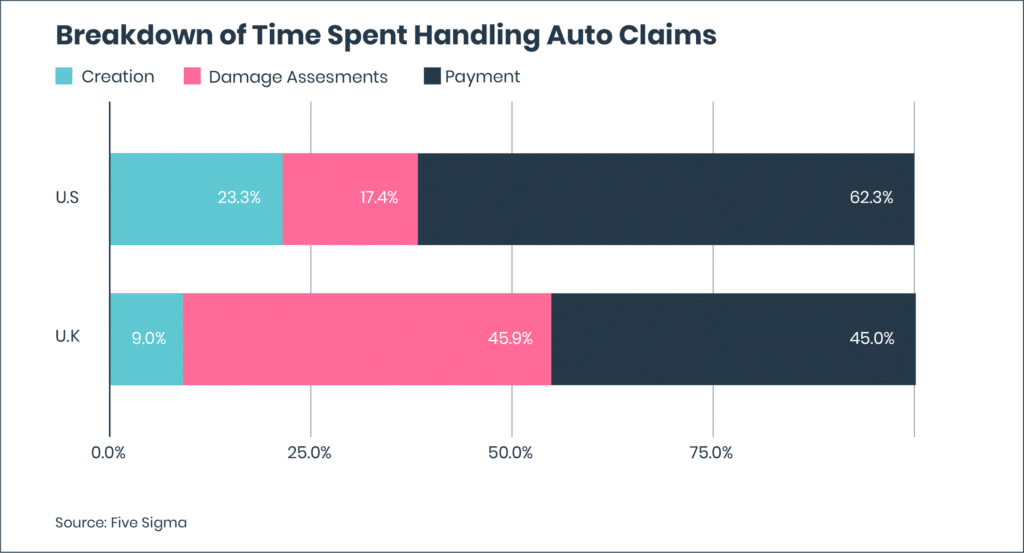

Our data also shed light on how time-consuming the various stages of processing a claim are, and how this varies between the U.S. and the U.K. While creating a claim accounted for less than a quarter of all handling time in both countries, we saw significant differences in the breakdown of the damage assessment and payment stages. Notably, while damage assessment was the least time-consuming stage in the U.S. (accounting for 17.4% of the time spent handling claims), it was the most time-consuming stage in the U.K. (accounting for 45.9% of the time spent handling claims).

Meanwhile, the time from assessment to payment took up a significant amount of time in both countries—45.0% in the U.K. and 62.3% in the U.S.

The big picture: Wide variability among claims adjusters

Perhaps the most important takeaway from our data is how varied the work of claims adjusters can be. For example, on average, pet insurance claims adjusters have more than twice as many open claims as auto insurance adjusters—and over four times as many active claims. And within each line of business, the numbers show that some claims adjusters have several times more open and active claims than their peers. Meanwhile, the varied expertise among claims adjusters means that many claims require the work of multiple adjusters in order to get resolved properly.

With so much variation among claims adjusters, it’s not hard to see the value of data-driven claims intelligence in helping adjusters boost their efficiency and their reliability. By providing just-in-time guidance, recommended next steps, and useful insights, an intelligent CMS can help any adjuster to perform as if they had the expertise, professional experience, and general qualities of their most successful peers.

In other words, with claims adjusters having such a wide variety of knowledge, experience, and performance metrics, using data effectively can help claims departments to boost their level of standardization and professional excellence.