Product Updates & Innovations, April 2025: Clive™ AI Assesses Claim Complexity

At Five Sigma, we’re constantly evolving to make our customers’ claims management experience better and exceptional. We’re thrilled to share the newest enhancements to our platform and Clive™, the AI Claims Adjuster – all designed to streamline claims operations and harness the power of automation and AI-native technology.

With Clive, AI claims management is now available to any insurer, MGA or TPA looking to add AI and automation to their existing claims system.

As a cloud-based SaaS – the platform and Clive are always up to date with the latest enhancements, for the benefit of all customers.

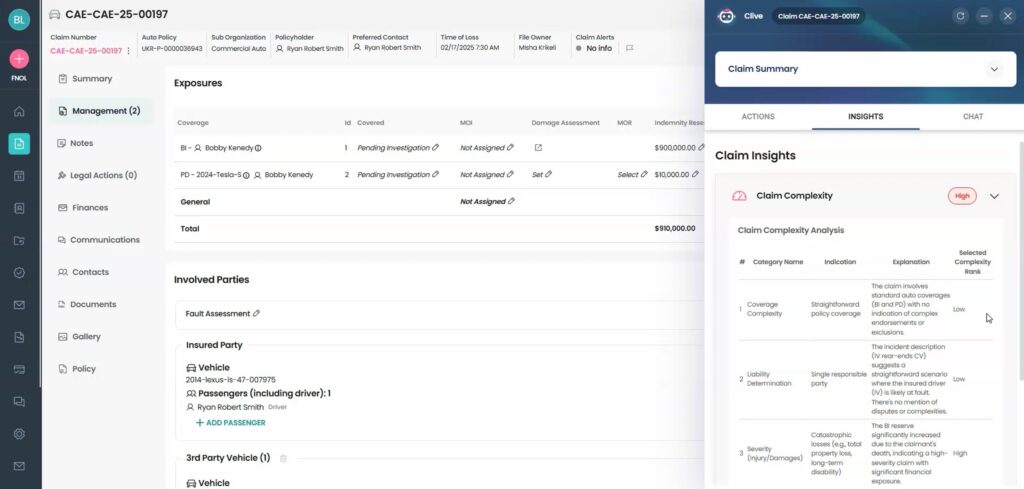

🤖Clive AI Continuously Assesses Claim Complexity

Clive provides real-time visibility into claim complexity, allowing effective triage and resource allocation. Clive automatically analyzes key data points like liability, severity, legal involvement, and regulatory factors, assigning each claim a dynamic complexity rating – Low, Medium, or High.

Clive continuously evaluates claim data throughout the claim lifecycle. As new information arrives, Clive automatically updates the complexity rating, providing claims teams with ongoing, real-time insights.

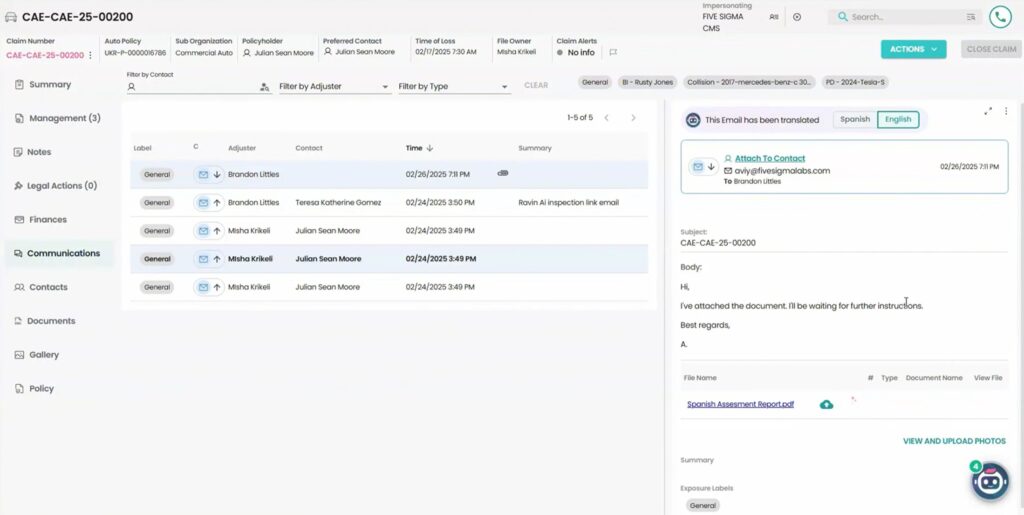

🤖 Clive AI Translates Claim Documents to Any Language

Five Sigma supports insurers around the globe and Clive makes cross-regional communications a lot easier! Clive can translate claim documents, emails, and notes instantly, right from within the Clive interface. No switching tools, no copy-pasting.

Every translation appears side-by-side with the original, helping adjusters verify accuracy, stay in context, and reduce misunderstandings.

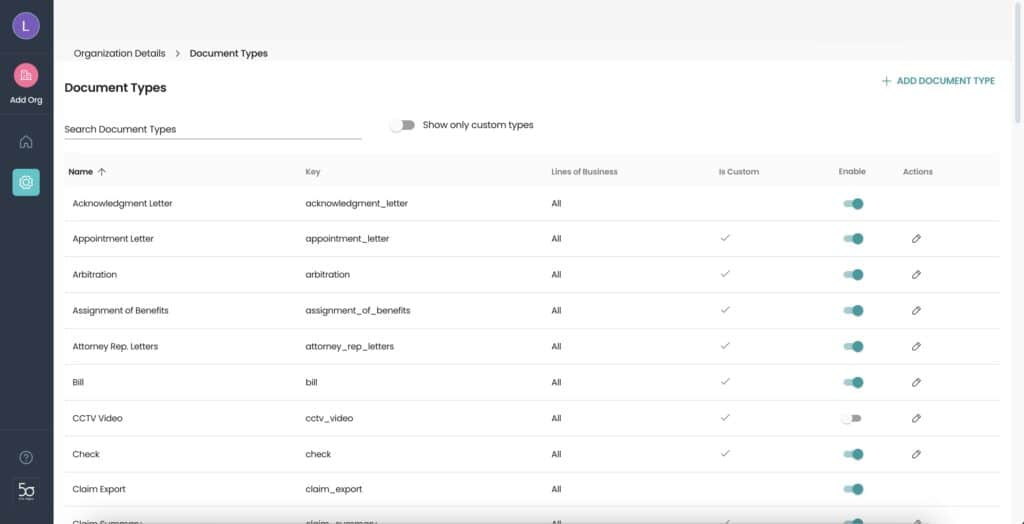

📝 Configurable Document Types

Instead of a hardcoded list, document types are now fully configurable through a new Document Types tab in the internal admin panel.

The new interface allows organizations to enable, disable, and create their own document types, while maintaining a set of required standard types.

This change provides greater flexibility to tailor document management to each organization’s specific needs.

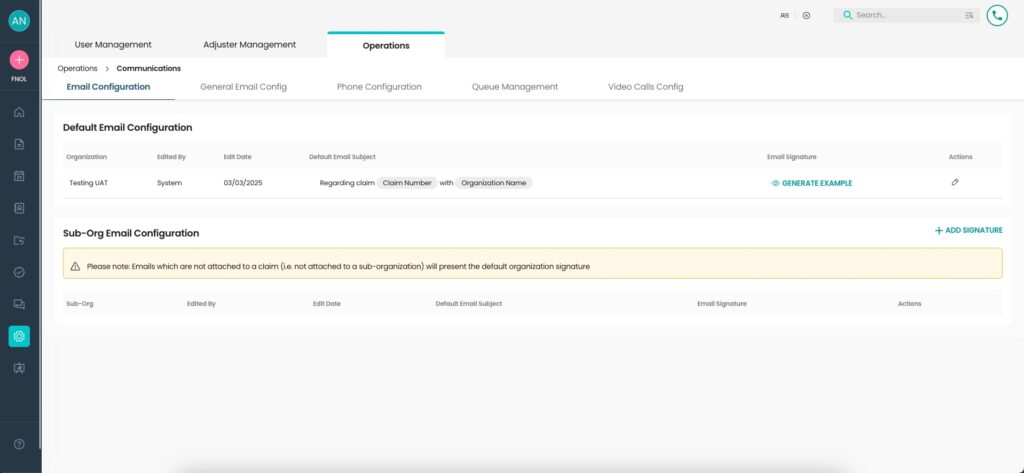

📧 Customizable Email Titles and Signatures

A new Email Configuration tab allows full customization of default email titles and signatures.

Organizations can define a required default title and signature at the organizational level, with the option to set overrides for specific sub-organizations.

When an email is not tied to a claim, the organization-level configuration will apply.

This update improves brand consistency across communications and reduces reliance on support for changes.