At Five Sigma, we’re constantly evolving to make our customers’ claims management experience better and exceptional. We’re thrilled to share the newest enhancements to our platform and Clive™, the AI Claims Adjuster – all designed to streamline claims operations and harness the power of automation and AI-native technology.

With Clive, AI claims management is now available to any insurer, MGA or TPA looking to add AI and automation to their existing claims system.

As a cloud-based SaaS – the platform and Clive are always up to date with the latest enhancements, for the benefit of all customers.

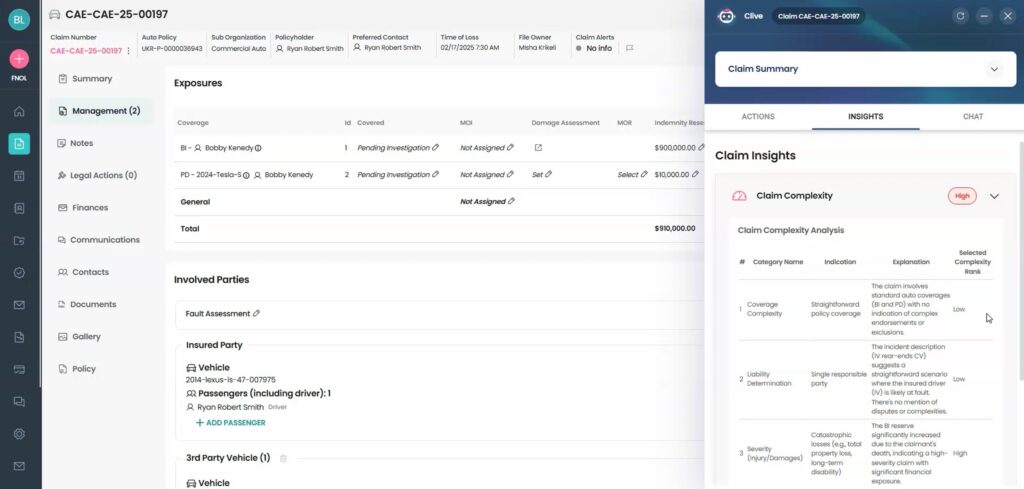

🤖Clive AI Continuously Assesses Claim Complexity

Clive provides real-time visibility into claim complexity, allowing effective triage and resource allocation. Clive automatically analyzes key data points like liability, severity, legal involvement, and regulatory factors, assigning each claim a dynamic complexity rating – Low, Medium, or High.

Clive continuously evaluates claim data throughout the claim lifecycle. As new information arrives, Clive automatically updates the complexity rating, providing claims teams with ongoing, real-time insights.

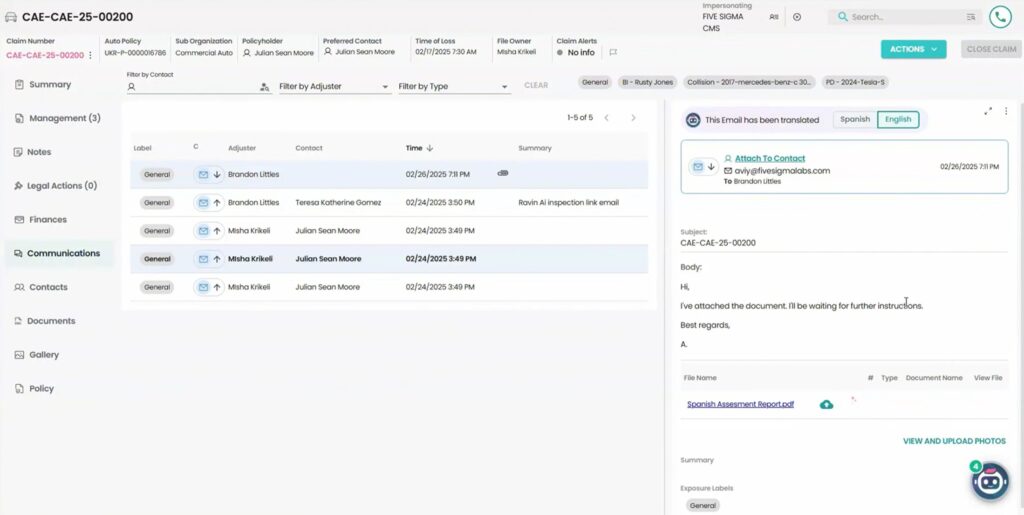

🤖 Clive AI Translates Claim Documents to Any Language

Five Sigma supports insurers around the globe and Clive makes cross-regional communications a lot easier! Clive can translate claim documents, emails, and notes instantly, right from within the Clive interface. No switching tools, no copy-pasting.

Every translation appears side-by-side with the original, helping adjusters verify accuracy, stay in context, and reduce misunderstandings.

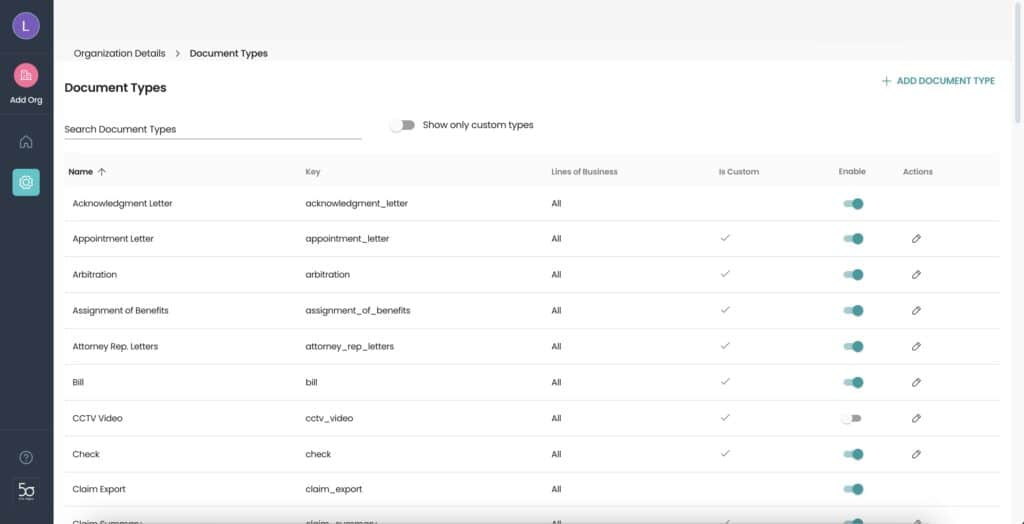

📝 Configurable Document Types

Instead of a hardcoded list, document types are now fully configurable through a new Document Types tab in the internal admin panel.

The new interface allows organizations to enable, disable, and create their own document types, while maintaining a set of required standard types.

This change provides greater flexibility to tailor document management to each organization’s specific needs.

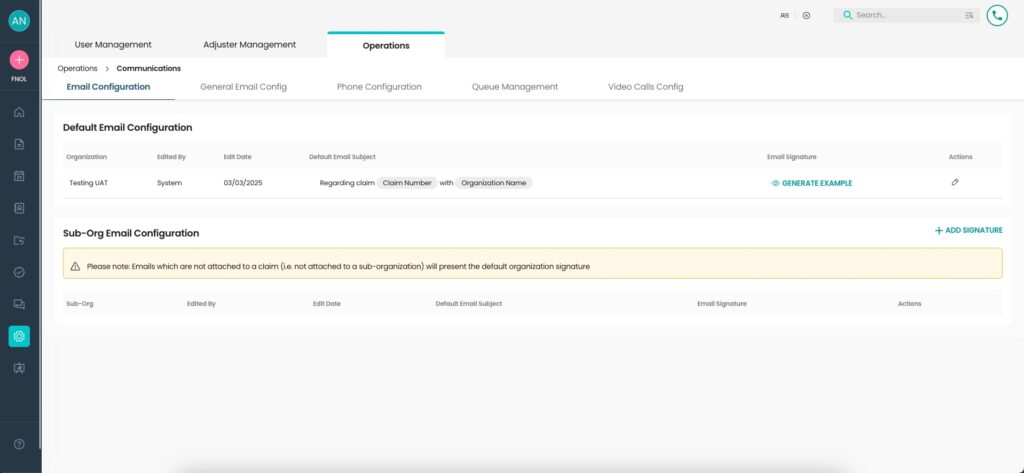

📧 Customizable Email Titles and Signatures

A new Email Configuration tab allows full customization of default email titles and signatures.

Organizations can define a required default title and signature at the organizational level, with the option to set overrides for specific sub-organizations.

When an email is not tied to a claim, the organization-level configuration will apply.

This update improves brand consistency across communications and reduces reliance on support for changes.